best tax saving strategies for high income earners

How to Reduce Taxable Income. Invest in Tax-Free Savings Accounts TFSA Among the best tax strategies for high income earners is to benefit.

Episode 67 Investing For High Income Earners Wealthability

The Setting Every Community Up for Retirement Enhancement SECURE Act which was part of the December 2019 tax package includes several provisions.

. Mon - Fri. Here are 50 tax strategies that can be employed to reduce taxes for high income earners. In this post were breaking down five tax-savings strategies that can help you keep more money in.

You are allowed to put in. According to the ATO youre classified as a higher income earner if you earn over 180000 a year. In this way the net income from the.

If you are an employee. Here are some of our favorite income tax reduction strategies for high earners. We will begin by looking at the tax laws applicable to high-income earners.

Dont discount the wealth-generating potential and flexibility an HSA can afford. Qualified Charitable Distributions QCD 4. As a high-income earner you may feel comfortable about your ability to cover out-of-pocket medical costs.

Use Roth Conversions Wisely and Regularly. Buying assets in your partners name. Converting some of your retirement account funds to a Roth is one of the most counter-intuitive tax strategies for high-income.

Lets start with an overview of tax rules for. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. A great tax saving strategy for self-employed high income earners is to record and track all of your business expenses.

Overview of Tax Rules for High-Income Earners. An overview of the tax rules for high-income earners. Structure your investments tax efficiently.

In fact Bonsai Tax can help. Tax laws change often and increasing complexity makes it hard to stay on top of the latest tax saving strategies for high income earners. If you have a high-deductible insurance plan you can put some of your money in Health Savings Accounts for retirement and medical purposes.

The SECURE Act. For this strategy to be effective your partner must have a lower marginal tax rate than you do. The more you make the more taxes play a role in financial decision-making.

6 Tax Strategies for High Net Worth Individuals. Tax Planning Strategies for High-income Earners. Our tax receipt scanner app will scan.

Taxes associated with your investments are driven by the types of. High-income earners make 170050 per year. A donor-advised fund is a charitable fund that allows you to decide how and when to allocate funds to charitiesThis is probably one of the best tax saving strategies for high income.

3 Tax-Saving Opportunities For High-Income Earners. In fact if youre earning in excess of 180000 youre taxed at 47 for the privilege. 50 Best Ways to Reduce Taxes for High Income Earners.

For instance the 2017 Tax Cuts and. 5 Outstanding Tax Strategies for High Income Earners. Max Out Your Retirement Account.

1441 Broadway 3rd Floor New York NY 10018.

4 Important Tax Strategies For High Income Earners

Chiropractic And How To Reduce Taxes For High Income Earners

High Income Earners Need Specialized Advice Investment Executive

6 Strategies To Reduce Taxable Income For High Earners

Tax Strategies For High Income Earners Wiser Wealth Management

Why Health Savings Accounts Are Appealing For High Income Earners

5 Outstanding Tax Strategies For High Income Earners

9 Ways To Reduce Your Taxable Income Fidelity Charitable

5 Tax Strategies For High Income Earners Pillarwm

Tax Saving Strategies For High Income Earners Ubos

Tax Advantaged Savings Accounts For High Income Earners Paces Ferry Wealth Advisors

5 Outstanding Tax Strategies For High Income Earners

Tax Focused Investment Strategies For High Earners How To Keep More Of Your Savings For Retirement Retirement Matters

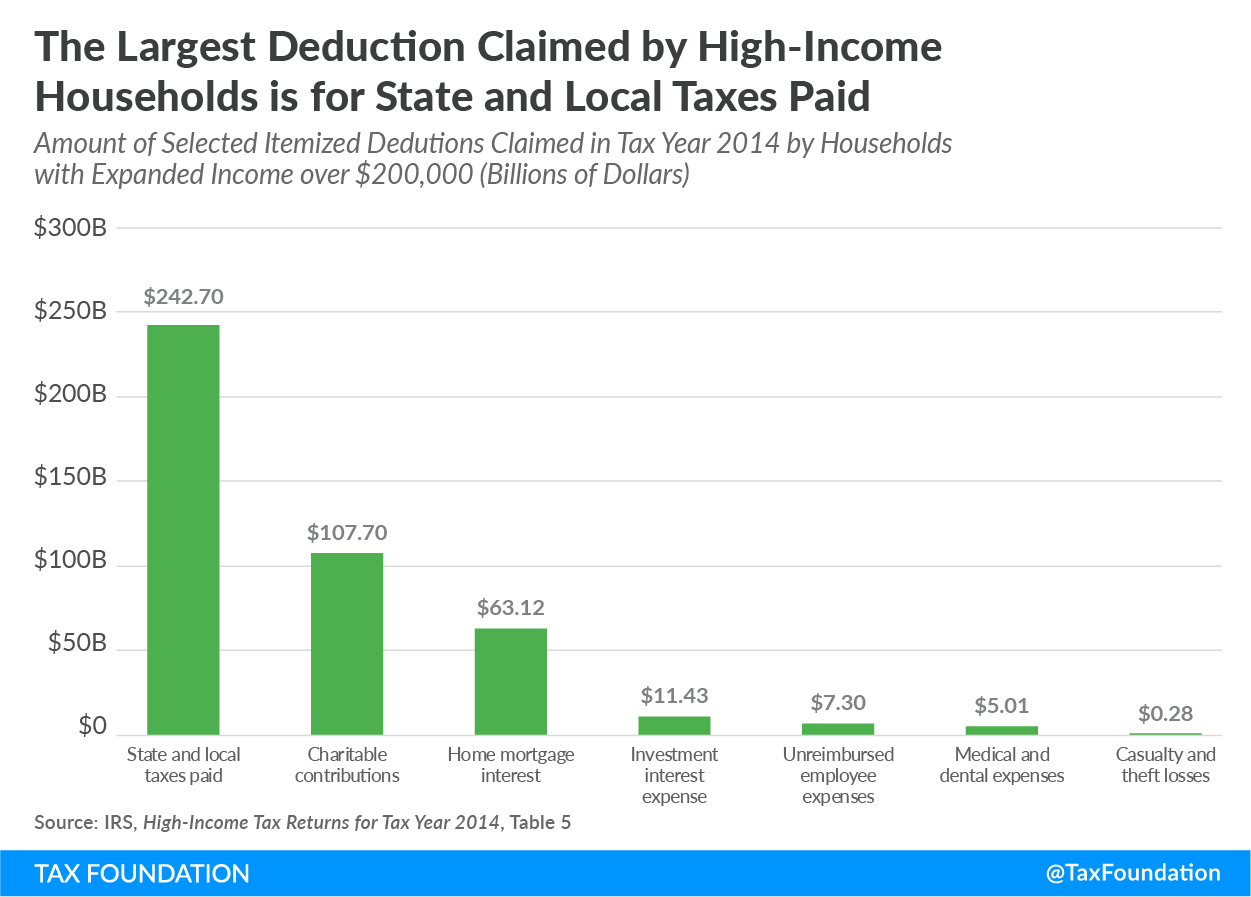

The Largest Deductions Taken By High Income Households Tax Foundation

Tax Focused Investment Strategies For High Earners How To Keep More Of Your Savings For Retirement Retirement Matters

![]()

Tax Strategies For High Income Earners

How The Tcja Tax Law Affects Your Personal Finances

2021 Taxes 8 Things To Know Now Charles Schwab

3 Paths To A Roth Ira For High Income Earners Charles Schwab