child tax credit december 2021 how much will i get

To reconcile advance payments on your 2021 return. You would be eligible to receive 1800 in 2021 and 1800 when you file your tax return.

Public Notice Update Banking Information To Get Reverse Tax Credit Barbados Today Tax Credits Motivational Skills Banking

President Biden has proposed extending the enhanced Child Tax Credit including monthly payments for at least 2022.

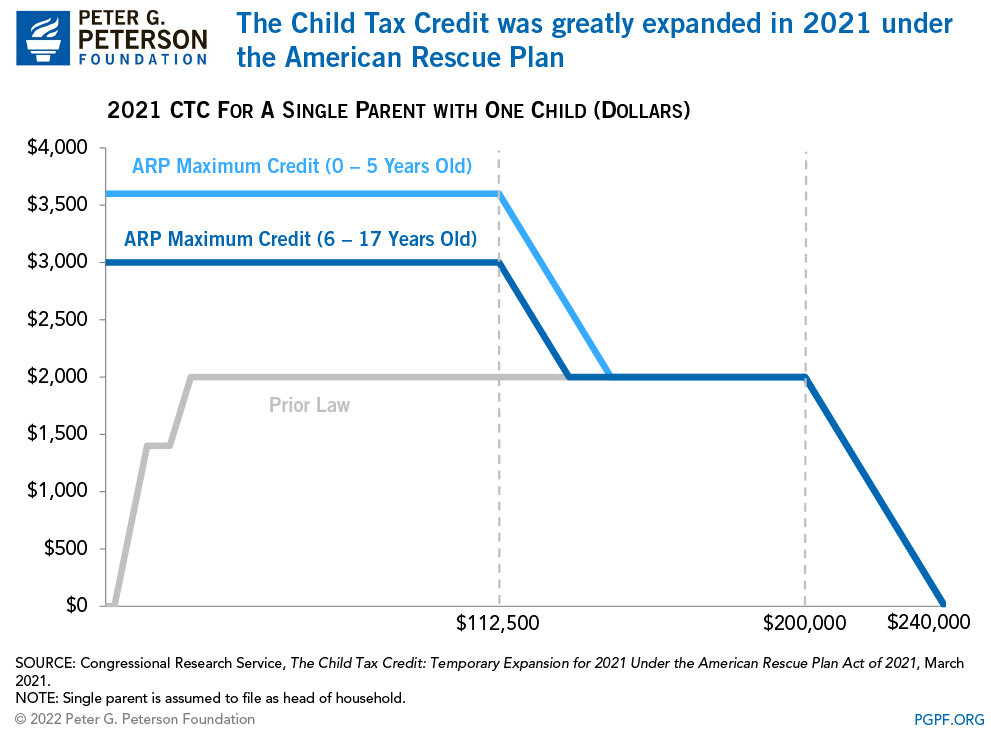

. The remaining 1800 will be claimed. The American Rescue Plan Act of 2021 temporarily expands the child tax credit for 2021. Children under 6 years old qualify for the full enhanced Child Tax Credit of 3600 if their single-filer parent earns less than 75000 or their.

These updated FAQs were released to the public in Fact Sheet 2022-17PDF March 8 2022. In December these families will receive a lump-sum payment of 1800 for younger children under six and 1500 for those between six and seventeen. Lets say you qualified for the full 3600 child tax credit in 2021.

You can also refer to Letter 6419. Under the new provisions families are set to receive a 3000 annual benefit per child ages 6 to 17 and 3600 per child under 6 in the tax year 2021. The credit will be fully refundable.

The 2021 advance monthly child tax credit payments started automatically in July. Second it increases the credit to 3000 per child 3600 per child under age 6 for many families. While you can get 3600 for every child under the age of six.

The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17. Among other changes the CTC was increased this year from 2000 per child to as much as 3600 per child as well as extended for the. Get your advance payments total and number of qualifying children in your online account.

It also provided monthly payments from July of 2021 to December of 2021. So far most qualifying parents should. Even though child tax credit payments are scheduled to arrive on certain dates you may not have gotten the money.

Visualize trends in state federal minimum wage unemployment household earnings more. If my 2021 income is higher than the thresholds for taking the 3000 or 3600 per-child tax credit do I still qualify for the 2000-per-child credit. Use CNETs calculator to make sure your household is getting the right amount.

The child tax credits are worth 3600 per child under six in 2021 3000 per child aged between six and 17 and 500 for college students aged up to 24. On Wednesday December 15 2021 child tax credit payments are set to roll out to millions of Americans. 2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out Cbs News Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet.

Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021 generally based on the. Third it makes the credit fully refundable and removes the 2500 earnings floor. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month.

If you took advantage of the advance child tax credit payments in 2021 your family was allowed to receive 50 of your estimated credit from July through December. Those who signed up will receive half of their total child tax credit payment up to 1800 as a lump sum in December. However under the new law families can get an increased tax break of 3000 for every child aged six to 17 for the 2021 tax year only.

Child tax credit december 2021 how much will i get Monday February 21 2022 Edit. If you have a newborn child in December or adopt a child you can claim up. However theyre automatically issued as monthly advance payments between July and December -.

The third advance monthly check comes Sept. Child tax credit enhancement Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis which accounts for half of. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Additionally a portion of your amount is reduced by 50 for every 1000 over certain income limits see the FAQs below.

For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000 per child for kids 6 to. If Married Filing Jointly If Letter 6419 Has a Different Advance Payments Total. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000 per child for kids 6 to.

Families who arent eligible for the 3000 or 3600 credit in 2021 but who have modified AGIs at or below 400000 on joint returns or 200000 on other returns can claim the regular credit of. Additionally those with dependents between the ages of 18 and 24 who are enrolled in college full-time can receive 500 for each. Part of the American Rescue Plan passed in March the existing tax credit an advance payment program of the 2021 tax return for people who are eligible increased from 2000 per child to 3600.

Ad Explore detailed reporting on the Economy in America from USAFacts. This will mark the final month of payments for 2021. Frequently asked questions about the 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic D.

First it allows 17-year-old children to qualify for the credit. The payment for children. Enter your information on Schedule 8812 Form 1040.

Politifact Advance Child Tax Credit Payments Won T Usually Require Repayment

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Child Tax Credit 2021 8 Things You Need To Know District Capital

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

Advance Child Tax Credit Payments Are Done But You Might Still Be Owed More Here S How To Find Out

Child Tax Credit Could Spur 1 5 Million Parents To Leave The Workforce Study Says Cbs News

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Child Tax Credit Is December The Final Check Deseret News

What Are The Costs Of Permanently Expanding The Ctc And The Eitc

Employee Retention Tax Credit Office Of Economic And Workforce Development

Child Tax Credit 2022 How Much Of Your Ctc Payment Is Expected In Your Refund Marca

Rrsp Tfsa Oas Cpp Ccb Tax And Benefit Numbers For 2021 Tax Numbers Tax Return

Adance Tax Payment Tax Payment Dating Chart

What Families Need To Know About The Ctc In 2022 Clasp

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver